Profit Path Advisors Ltd is a registered consultancy firm specializing in accounting, tax advisory, audit, and business advisory services. Established in 2012, the firm has gained extensive competitive advantage in providing advisory services. At Profit Path, we are committed to helping businesses thrive in today’s competitive landscape. Whether you’re a startup aiming to scale, an established company seeking new growth opportunities, or a foreign business exploring Rwanda, we provide tailored business advisory solutions that drive success. As we walk alongside you and your business, we help you to implement strategies and increase profitability.

About us

Our Vision

To build a thriving successful business, advising organizations and businesses to compete effectively in their industries, ensuring long-term success and resilience in an ever-evolving global market.

Our Mission

We are committed to providing tailored, innovative, and sustainable solutions that address our clients’ unique challenges and foster growth, efficiency, and resilience. We unlock our clients’ full potential, ensuring they thrive and confidently navigate evolving global dynamics.

Values

- Integrity and Ethical Conduct: We promote honesty and transparency in every aspect of our business relationships and ensure ethical practices

- Innovation: We believe in providing innovative solutions by crafting data-driven strategies and adopting new technologies as today’s world rapidly evolves.

- Excellence and Professionalism: We aim to provide the highest quality service while respecting international business standards.

- Confidentiality and Trust: We value client’s information and commit to safeguarding their data through confidentiality agreements.

Accounting Services

Bookkeeping & Data Entry

- Record all financial transactions (sales, expenses, payments)

- Automate bank feeds and reconcile accounts in real-time

- Categorize expenses for clean reporting

- Upload and organize receipts and documents

Payroll Management

- Salary Calculations and Process employee salaries on time

- Calculate gross pay, deductions, and net pay

- Include bonuses, overtime, and allowances

Employee Data Management

- Collect and maintain employee records (contracts, tax IDs, bank info)

- Update changes in salary, roles, or benefits

Tax & Statutory Compliance

- Calculate and file PAYE, pension (e.g., RSSB in Rwanda), and other deductions

- Submit reports to tax authorities and social security boards

- Ensure compliance with labor laws

Payslip Generation & Distribution

- Create and send monthly payslips to employees securely

- Provide breakdown of earnings and deductions

Payroll Disbursement

- Process salary payments via bank or mobile platforms

- Ensure timely disbursement aligned with pay cycles

- Leave & Benefits Management Handle benefits, bonuses, and statutory contributions

- Track paid/unpaid leave balances

- Account for sick leave, maternity leave, and holidays

Payroll Reporting

- Generate monthly payroll summary reports

- Support audit readiness with proper documentation

Employee Support & Queries

- Handle employee questions about payslips or deductions

- Update records in response to life/work changes

Invoicing & Accounts Receivable

- Generate and send branded invoices

- Set automated payment reminders

- Track who owes you and when

Expense & Accounts Payable Management

- Track bills and supplier payments

- Schedule vendor payments to avoid late fees

- Manage recurring expenses

Financial Reporting

- Monthly Profit & Loss, Balance Sheet, and Cash Flow Statements

- Financial analysis for guiding decision-making process

- Budget Design and Implementation Support

Tax Preparation & Filing

- Calculate VAT,WHT, corporate income tax, PAYE, and other local taxes

- Submit returns to the tax

- Maintain audit-ready records

Compliance & Regulatory Support

- Create internal controls and provide support during implementation

- Internal audit and due diligence

- Assist in filing annual returns and

- Represent clients in tax matters and technical discussions with tax authorities.

Business Advisory & Financial Strategy

- Financial planning

- Fundraising support

- Cost control and profit optimization

- Investment Advisory services

Onboarding & Training

- Set up and migrate to cloud accounting software

- Customize chart of accounts for your industry

- Train founders and staff on how to use the system

- Ongoing technical support

Strategic Benefits You Can Leverage

- Cutting costs for higher salaries

- Leverage time to focus on your business

- Getting high quality service from qualified accountants

- Access real time reports and management reports

- Monthly key findings and recommendations to fix everything on time

- Encrypted cloud storage

Recruitment

- Full recruitment

- Head hunting for executives

- Outsourced HR

Meet Our expert team

Our expert team brings together strong leadership, technical excellence, and innovative thinking to deliver professional results for every client.Jules is a business advisor with 18+ years of experience in logistics

The IT Assistant at ProfitPath supports system administration, website development, and technical troubleshooting to ensure smooth digital operations.

Our Pricing Philosophy

Transparency & Clarity

We provide fixed, upfront pricing with a clear scope of work no hidden fees, no surprises. We’re always happy to explain our pricing options to match your needs and budget.

Value-Based Approach

Our pricing reflects the value we deliver, not just time spent. Tiered packages let you choose the level of support that fits your growth goals.

Fixed & Project-Based Fees.

For most services, we offer fixed fees or project-based pricing so you can budget with

confidence and pay for outcomes, not hours.

Client-Centric & Flexible

Your business is unique. We tailor our pricing to suit your goals, and we’re committed to long-term relationships built on honesty and trust.

Competitive & Fair.

We benchmark our rates to ensure competitive pricing, while delivering unmatched value and results.

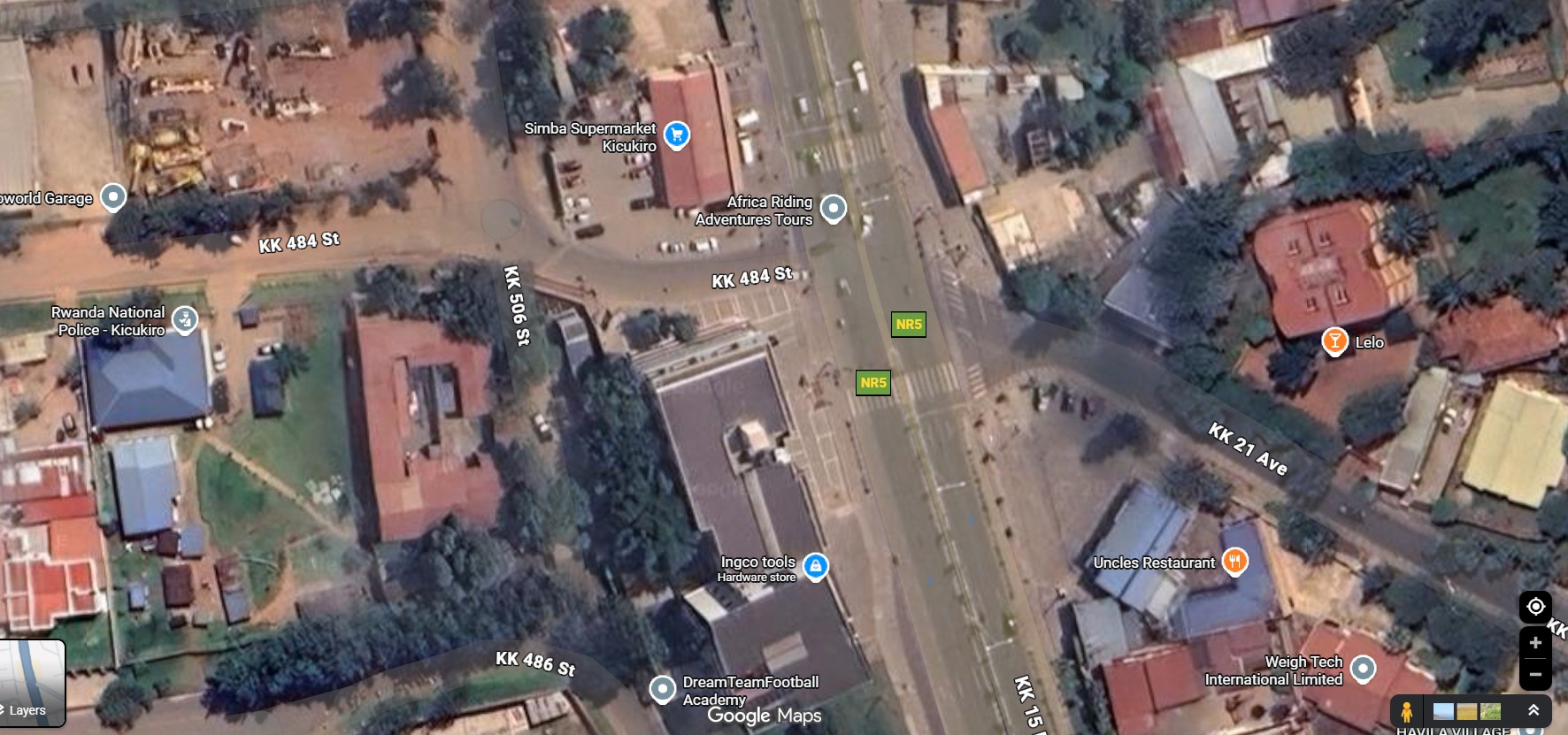

CONTACT US